Optimax provides quality HD video systems and modern IP phone systems。

Optimax systems have been installed in homes, banks, retail stores, hospitals, and restaurants. We minimize our operation costs and pass the savings to you. We guarantee the lowest price on all our services, please call for free estimate.

Please feel free to contact us. Monday - Friday: 7am - 5 pm Pacific Standard Time.

Optimax Enterprise Inc.

9436 La Rosa Dr. Temple City, CA 91780

Tel: 626-297-1344; 626-380-2328

投资基本原则 (5)

過去二周美國股市跌幅很深,不同年齡段的投資人各有那些該注意的事情?

已退休或即將退休的人看到退休賬戶裡頭的養老金縮水,心裡難免緊張。對這一群人,專家建議此時應將投資組合裡的資產配置調整為保守一點。2009年時的投資組合如為60%股票40%債券,經過近10年的股市繁榮,則此時它們比重變為80%股票20%債券(如果不曾動用或調整)。此時投資組合裡不同資產間的比重應再調整。(可以找理財顧問咨詢這方面理財策略的問題)。同時要有適量的現金,讓你在股票被套牢時,不必賠錢拋售來換取過日子的錢。股市行情好的時候,投資人會傾向於多花錢,此時應適度減少提取退休賬戶的錢,然後按預算用錢。

50歲左右的人,此時應該增持會產生固定收益的優質股票或債券。考慮保守但穩定的中期債券,雖然這類資產最近的市場表現不如人意。但在股市走跌時它們是較能抗跌的資產。

雖然投資股票長期持有對年輕人是有利的,30歲上下的投資者在此股市看跌時可以不必變更投資策略,反倒可在此股價走低時尋找機會,用"平均成本法"陸續買進。目前的股價並不算便宜,不必盡其所有一次拿來買股。年輕人也應准備中短期需要的現金,如准備用於結婚或付買房的頭期款等等。 年輕人把所有的錢用於股票並不合適,投資組合裡仍應有備用現金和持有中短期債券。

Whenever there’s a discussion about active or passive investing, it can pretty quickly turn into a heated debate because investors and wealth managers tend to strongly favor one strategy over the other.

Understanding the Difference

If you’re a passive investor, you invest for the long haul. Passive investors limit the amount of buying and selling within their portfolios, making this a very cost-effective way to invest. The strategy requires a buy-and-hold mentality. That means resisting the temptation to react or anticipate the stock market’s every next move.

The prime example of a passive approach is to buy an index fund that follows one of the major indices like the S&P 500 or Dow Jones. Whenever these indices switch up their constituents, the index funds that follow them automatically switch up their holdings by selling the stock that’s leaving and buying the stock that’s becoming part of the index. This is why it’s such a big deal when a company becomes big enough to be included in one of the major indices: It guarantees that the stock will become a core holding in thousands of major funds.

When you own tiny pieces of thousands of stocks, you earn your returns simply by participating in the upward trajectory of corporate profits over time via the overall stock market. Successful passive investors keep their eye on the prize and ignore short-term setbacks – even sharp downturns.

Active investing, as its name implies, takes a hands-on approach and requires that someone act in the role of portfolio manager. The goal of active money management is to beat the stock market’s average returns and take full advantage of short-term price fluctuations. It involves a much deeper analysis and the expertise to know when to pivot into or out of a particular stock, bond or any asset. A portfolio manager usually oversees a team of analysts who look at qualitative and quantitative factors, then gaze into their crystal balls to try to determine where and when that price will change.

Active investing requires confidence that whoever’s investing the portfolio will know exactly the right time to buy or sell. Successful active investment management requires being right more often than wrong.

Which Strategy Makes You More

So which of these strategies makes investors more money? You’d think a professional money manager’s capabilities would trump a basic index fund. But they don’t. If we look at superficial performance results, passive investing works best for most investors. Study after study (over decades) shows disappointing results for the active managers. In fact, only a small percentage of actively managed mutual funds ever do better than passive index funds. But all this evidence to show passive beats active investing may be oversimplifying something much more complex because active and passive strategies are just two sides of the same coin. Both exist for a reason and many pros blend these strategies.

A great example is the hedge fund industry. Hedge funds managers are known for their intense sensitivity to the slightest changes in asset prices. Typically hedge funds avoid mainstream investments, yet these same hedge fund managers actually invested about $50 billion in index funds last year according to research firm Symmetric. Ten years ago, hedge funds only held $12 billion in passive funds. Clearly, there are good reasons why even the most aggressive active asset managers opt to use passive investments. (For more, see A Statistical Look at Passive vs. Active Management.)

Strengths and Weaknesses

In their Investment Strategies and Portfolio Management program, Wharton faculty teaches about the strengths and weaknesses of passive and active investing.

Passive Investing

Some of the key benefits of passive investing are:

Ultra-low fees – There's nobody picking stocks, so oversight is much less expensive. Passive funds simply follow the index they use as their benchmark.

Transparency – It's always clear which assets are in an index fund.

Tax efficiency – Their buy-and-hold strategy doesn't typically result in a massive capital gains tax for the year.

Proponents of active investing would say that passive strategies have these weaknesses:

Too limited – Passive funds are limited to a specific index or predetermined set of investments with little to no variance; thus, investors are locked into those holdings, no matter what happens in the market.

Small returns – By definition, passive funds will pretty much never beat the market, even during times of turmoil, as their core holdings are locked in to track the market. Sometimes, a passive fund may beat the market by a little, but it will never post the big returns active managers crave unless the market itself booms. Active managers, on the other hand, can bring bigger rewards (see below), although those rewards come with greater risk as well.

Active Investing

Advantages to active investing, according to Wharton:

Flexibility – Active managers aren't required to follow a specific index. They can buy those "diamond in the rough" stocks they believe they've found.

Hedging – Active managers can also hedge their bets using various techniques such as short sales or put options, and they're able to exit specific stocks or sectors when the risks become too big. Passive managers are stuck with the stocks the index they track holds, regardless of how they are doing.

Tax management – Even though this strategy could trigger a capital gains tax, advisors can tailor tax management strategies to individual investors, such as by selling investments that are losing money to offset the taxes on the big winners.

But active strategies have these shortcomings:

Very expensive –Thomson Reuters Lipper pegs the average expense ratio at 1.4% for an actively managed equity fund, compared to only 0.6% for the average passive equity fund. Fees are higher because all that active buying and selling triggers transaction costs, not to mention that you're paying the salaries of the analyst team researching equity picks. All those fees over decades of investing can kill returns.

Active risk – Active managers are free to buy any investment they think would bring high returns, which is great when the analysts are right but terrible when they're wrong.

Making Strategic Choices

Many investment advisors believe the best strategy is a blend of active and passive styles. For example, Dan Johnson is a fee-only advisor in Ohio. His clients tend to want to avoid the wild swings in stock prices and they seem ideally suited for index funds.

He favors passive indexing but explains, "The passive versus active management doesn’t have to be an either/or choice for advisors. Combining the two can further diversify a portfolio and actually help manage overall risk."

He says for clients who have large cash positions, he actively looks for opportunities to invest in ETFs just after the market has pulled back. For retired clients who care most about income, he may actively choose specific stocks for dividend growth while still maintaining a buy-and-hold mentality.

Andrew Nigrelli, a Boston-area wealth advisor and manager, agrees. He takes a goals-based approach to financial planning. He mainly relies on long-term passive investment indexing strategies rather than picking individual stocks and strongly advocates passive investing, yet he also believes it isn’t just returns that matter, but risk-adjusted returns.

"Controlling the amount of money [that] goes into certain sectors or even specific companies when conditions are changing quickly can actually protect the client."

For most people, there’s a time and a place for both active and passive investing over a lifetime of saving for major milestones like retirement. More advisors wind up using a combination of the two strategies – despite the grief the two sides give each other over their strategies.

Read more: Active vs. Passive Investing | Investopedia https://www.investopedia.com/news/active-vs-passive-investing/#ixzz514qMTQQl

平衡型基金(balanced fund) 投資於股票與債券。因債券價格不會跟著股市波動而變化,這使平衡型基金在股市崩盤時不會跟着產生大幅的跌價損失。

一般人買基金時都只注重其報酬率成長,認為只有股票能為自己賺多一點錢,因此常常都偏好純投資股票的成長型基金(growth fund)。平衡型基金在股市快速上揚時往往沒能以同樣速度上升,很多投資人就不喜歡。

今天我們將平衡型基金跟S&P 500 (標普500 指數) 和 成長型基金一起比較。用具體的字來顯明:平衡型基金在股市大幅下滑時的抗跌特性, 這特性使它可以產生比成長型基金或指數型基金還好的投資結果。

我用American Balanced fund-ABALX 為平衡型基金的代表。它 的投資成分是60% 股票,40% 債券。成長型基金用American Growth fund- AGTHX 為代表。

所有的資料,如報酬率,投風險系數均從Yahoo Finance 取得。

第一個情境 (見下圖), 假設於2008年初 將$10,000分別放入 ABALX,S&P 500及AGTHX 三個賬戶 , 在2017年底它們的結果分別是:$20,300和 $22,599.$22,233.可以看到保守型基金ABALX的結果是最差的。

但再仔細一點看, ABALX 於2008年產生的跌價損失,在2010年時就被賺回來; S&P500或成長型則需要到2012年才能補回損失。而且ABALX 的成果從頭就一直是三者中成績最好的,直到2014年被S&P500 趕上。

我們因此可以得一結論-假如有一筆錢我們可能在3-5年內要花用,則買保守型的平衡基金比較妥當; 即便我們投資後不久便遇上股市大跌,我們可以快速反彈得到盈餘。

100% 第二種情境(見下圖),於2000年初你將錢$10,000分別放入 ABALX,S&P 500及AGTHX , 在2017年底則它們的結果分別是: $39,215, $25780和$34,197。保守型基金ABALX的結果最好。更明確地說,從2000年至2017年,每年ABALX的成績一直是三者中最好的 。因為 從2000年到2017年市場共有兩次的大跌。ABALX平衡型的基金, 在那時發揮了抗跌的保護功能。要知道: $100 跌50%變成$50. 但它須漲才能變回$100.

這些實際數字,可讓我們學到兩個原則:

1. 在預測股市會下滑時用平衡型基金避險是好的策略。

2. 假如有一筆錢我們可能在短期內要花用,我們應該投資於平衡型基金,而不是純投資於的指數型或成長型基金。

最後聲明-我不是推薦任何基金,也不表示使用的例子的就是優於其他基金,也不保証這些樣本的未來表現會如何。讀者或觀眾大可拿其他基金用同樣的方法比較分析。

https://www.trulia.com/real_estate/Los_Angeles-California/market-trends/

Rental income -(mortgage interest + insurance + repair + property tax) = gain (return) from payment = G(x)

G(X) / purchase cost = Annual Gn %

Gn% + 5% = annual rate of return of property in Los Angeles

The only controllable expense is mortgage expenses, if you have put down more cash, less mortgage interest, then you have higher Gn%

Basics of Investment Concepts

我们讨论投资时常会用到的几个重要概念:

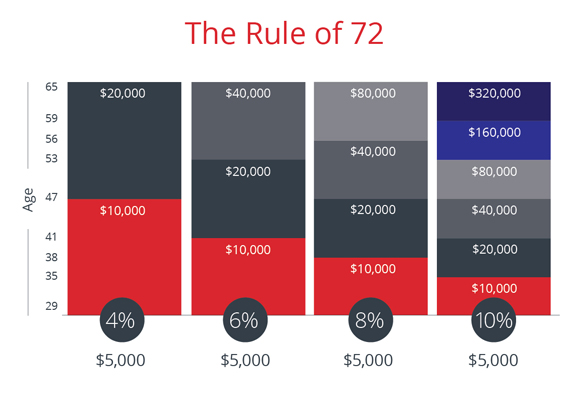

72法则

我们投资赚钱,用钱赚钱,对它增长的速度就应清楚掌握。 老中对数字,利率的比较都很精明, 但美国人一条“72法则”的运用很能传神地表达货币复利成长的速度,又容易计算。

72法则让我们容易估算一笔钱花多少时间可以成长一倍。 只要将72除以利率(获利率),所得的数字就是成长一倍所需年数。

看下图,假设你于29岁投资$5000, 65岁时的结果是多少, 在利率为4%时, 18年翻一倍;6%时, 12年时翻一倍, 8%时, 9年;。。。

风险vs 报酬

要高报酬,就会有高风险。不想有投资风险,投资报酬就会低。

投资时间长就不必害怕股市短期内的差劲表现,因为长期的平均报酬率表现是有潜力走高的。

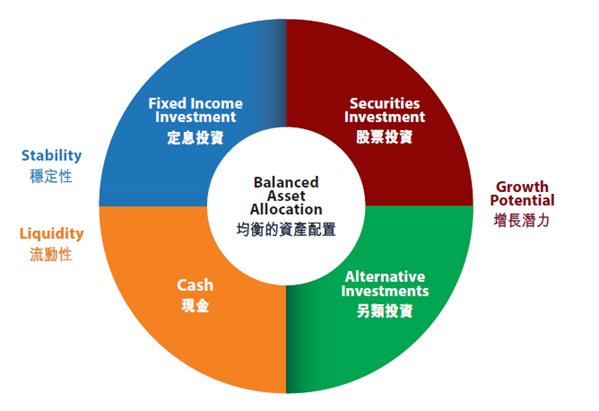

资产配置

将你的钱放在不同的资产:股票,债券,及现金。这三种资产有不同的风险特性。他们之间的风险关联性不高,也就是他们的价值很少同时上涨或同时下跌。

就你对风险的喜好和投资时间的长短而作相对的资产配置。 将钱放在不同的资产,给与不同的比重,将会避免过多的损失。

多样化

将你的资产配置做更深入的多样化处理。将你的投资放在不同的产业,不同的公司,依市场情况的不同再做不同的调配

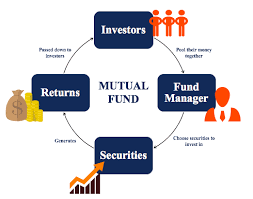

要有足够的时间和知识来做有效的多样化投资不是容易的事情。美国证管会就报告过,通过共同基金(互惠基金)是投资多样化的好工具。

如下图所示, 你喜欢电梯是由单条绳索或多条绳索支撑?虽然一个多样化的投资组合不能保证它的表现会高于单元的投资,但多样化是长期投资的降低风险的重要方法。

再平衡

随着时间的推进,投资组合里的各类资产比例就会与原来计划的比重产生差异。因为部分资产会其他资产表现较佳,因此在这有组合里就占有较大的比重。 尽管这可能是短期的现象,你会发现你的实际投资会偏重于股票或债券,如此就偏离原来分散风险的策略,而加大了风险或降低了获利能力。所以你需定期检查你的投资成果,再按策略里的计划把投资金额从新配置。

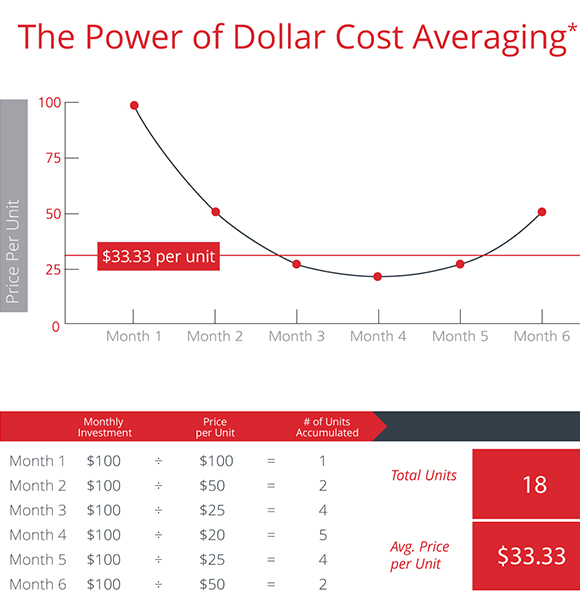

成本平均法

逢低买进,高价卖出是每一投资人想做到的事。但预测市场走向不是容易单的事。 利用平均成本法投资是一明智的手段。

成本平均法是长时间的定期,定额的投资,不管投资时的股价是多少。不同于将全部的钱放于单笔投资。 也就是每月放$100比在年底时放$1200 来得稳健。

按此方法,投资人于股价低时买进较多数量的股票,高股价时买较少的数量。长期来看,卖该股票而获利的概率是大的 -短期大盘走低时,虽然可能也无法保证获利。

Abstract: Whatever you want to get out of investing, be it a secure retirement, a house, education, or whatever else, good investment strategy is about knowing how to allocate your funds wisely. There are several tried-and-true methods used by millions of investors to build wealth. These methods include the various formula investment plans, including dollar-cost averaging. To assist you in learning about formula investing, there are tutorials on diversification and bull and bear markets; these give you a sense of how the larger market works.

Rebalancing is returning your portfolio to its intended asset allocation mix, which is the best way to keep your long-term strategy on track. Regular rebalancing is a standard recommendation from most financial professionals, who either sell off investments or purchase new investments to restore the correct balance.